How To Write A Donation Receipt

Cash donations are deductible up to a limit of 60 of your AGI. I wish to request for a three months internship from June to August 2020 to improve my practical skills in engineering.

Free Donation Receipt Templates Silent Partner Software

Its confusing to the donor to receive a thank-you email and then a separate donation receipt email.

. Include the date of the letter along with the name and contact details of the organization. Goodwill Central Coast information for tax return with address of your donation center. Your charitable donation must be made to a qualified organization and the amount you can deduct depends on the type of donation youre making.

I hereby write to request for an internship in your company BIDCO Engineers. Also give your complete name your mailing address and the. You may also want to request for a receipt to verify that they have canceled your subscription or membership.

A cash donation is the donation of money transferred through several methods such as by check or through payroll deduction. Remember the donors interaction with your nonprofit is about how they feel and how smooth the process is for them not about your convenience. I am interested in learning and acquiring experience in safety equipment installation plumbing drainage as well as other services provided by your.

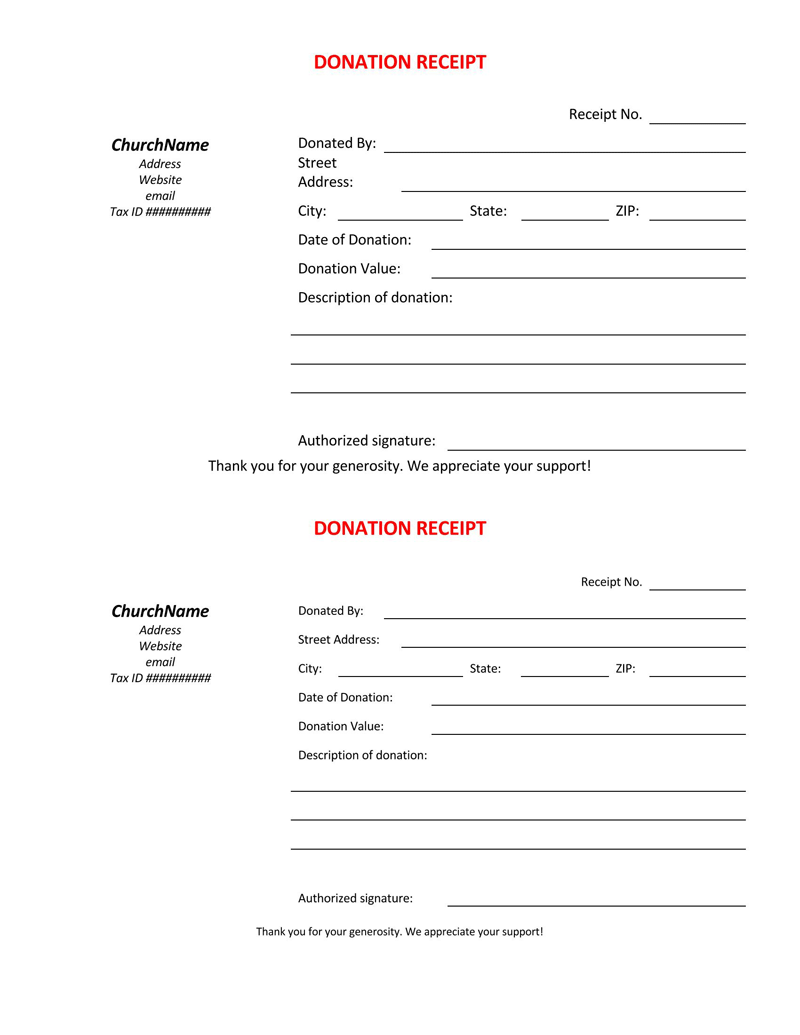

Thanking your donors for their contributions and letting them know how grateful you are for their support is a key element of successful church donation letters. When people make a donation using their joint account you can write one or both of their names on the donation receipt. This helps your church members to feel valued and involved in the work your church is doing.

Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition only on the date of the donation. Further this helps you can maintain a strong relationship with your congregation and. In addition Goodwills name Goodwill Retail Services Inc store address and identification number 39-2040239 must be completed.

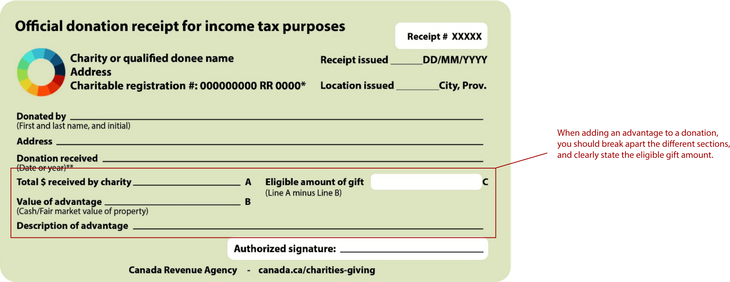

Here are some tips to help you out as you write a cancellation letter. A registered charity can only issue an official donation receipt to the individual or organization that made the gift and the name and address of the donor must appear on the receipt. A member of the management staff must verify that the donation receipts match the completed form and fill in the date of donations in this section.

For best results write a personal acknowledgment letter that includes the IRS-required elements.

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Templates Samples Word Pdf Eforms

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Free Donation Receipt Templates Silent Partner Software

Donation Receipt Template Pdf Templates Jotform

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Post a Comment

Post a Comment